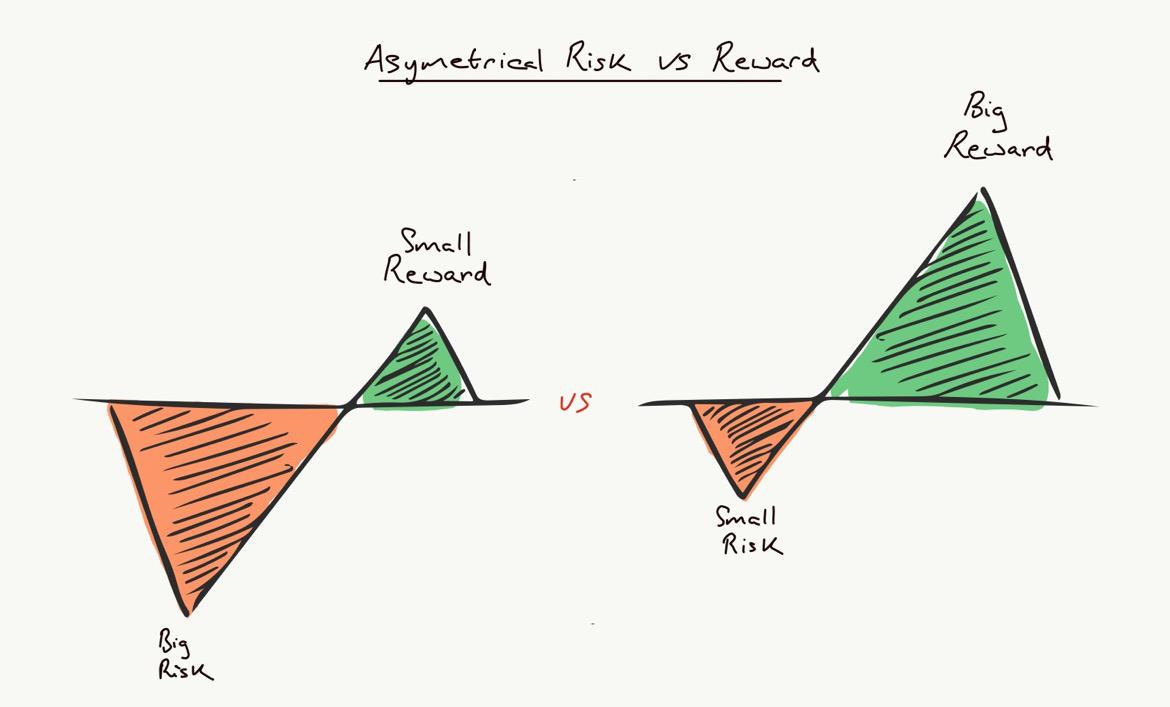

**Asymmetrical Risk vs Reward**

Over the years we’ve presented and advised on many situations related to dental practice ownership. We came across the above drawing recently. This drawing perhaps visually demonstrates our guiding philosophy best. We always attempt to minimise risk. However, we also consider risk in the context of rewards and upside.

For example, a dental practice start-up in a saturated and competitive metropolitan area is probably best represented by the left side of the drawing. There is considerable risk with minimal rewards. To break it down further, the considerable risk is associated with the cost to start-up as well as the difficulty in getting new patients and increasing billings and profitability. The little reward that is there will probably only eventuate many years down the track (if at all) and is not commiserate with the risk involved. The surgery would likely only ever get 1 or 2 chairs full. There is also an opportunity cost – would the time, efforts and money have been better served in another venture?

Contrast this with starting up in an outer metropolitan or less competitive area. Yes, there is a cost to start-up. However, appointment books would likely be better filled leading to increasing billings and profitability. The value of the business at any one point would likely be more than it cost to start-up. The number of chairs possible also would not be capped with considerable upside present. In well run dental clinics, generally as billings increase so will profits.

Similarly, translate this to buying practices. Those with growth opportunities will have a much lower risk and more upside in the long run compared to those without. We see this everyday in our consulting business. There are many many underworked practices out there that just need a motivated owner to see its true potential. As much as we talk about over-servicing in our industry, in our experience, under-servicing or not offering the ideal treatment is much more prevalent. Further, increasing opening hours, marketing and adding procedures are other ‘easy’ growth opportunities.

In comparison, we also see the practices with 1 or 2 high billing experienced owners that are probably being run at their most efficient and any upside has been realised already. These practices typically offer the whole range of dental treatments. Opening hours are probably at their maximum. The risk is substantial as the goodwill and in turn the profits are linked with the practioners. If they leave, then the goodwill and profits leave with them. Given the excellent profitability and billings, the asking prices for these practices are also towards the higher end. There is little upside for the average purchaser. This is not to suggest that these practices are always risky with little upside. For the right buyer there may be opportunity present.

Please feel free to comment or add to the discussion. If you have enjoyed this post, please like, share or comment below.

Our next practice ownership seminar is coming up in Brisbane on the 18th and 19th August 2023. This seminar has sold out in previous years – please register ASAP to avoid missing out.

https://practiceownership.com.au/dental-practice-startup-and-buying-seminar-2023/

We also offer expert guidance in various areas of practice ownership. Please see the below link for more information.